Eitc Requirements 2025

Eitc Requirements 2025. Earned income tax credit adjusted income caps Use the eitc tables to look up maximum.

Use the eitc tables to look up maximum. 26, 2025 — the internal revenue service and partners around the nation today launched the annual earned income tax credit awareness day outreach.

26, 2025 — the internal revenue service and partners around the nation today launched the annual earned income tax credit awareness day outreach.

2025 Tax Bracket Changes and IRS Annual Inflation Adjustments, Eitc can be a boost to you, your family. File form 1040, form 1040a, or form 1040ez.

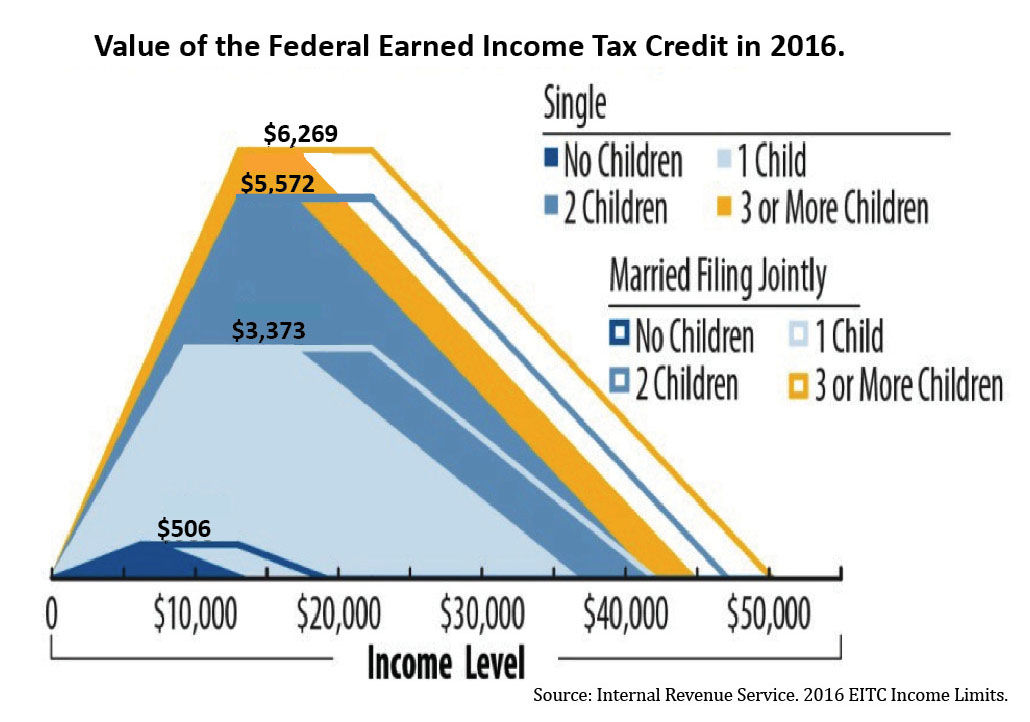

2025 IRS Inflation Adjustments Tax Brackets, Standard Deduction, EITC, You have until may 17, 2025 to file a tax return (or an amended return) for the 2025 tax year. See the earned income and adjusted gross income (agi) limits, maximum credit for the current year,.

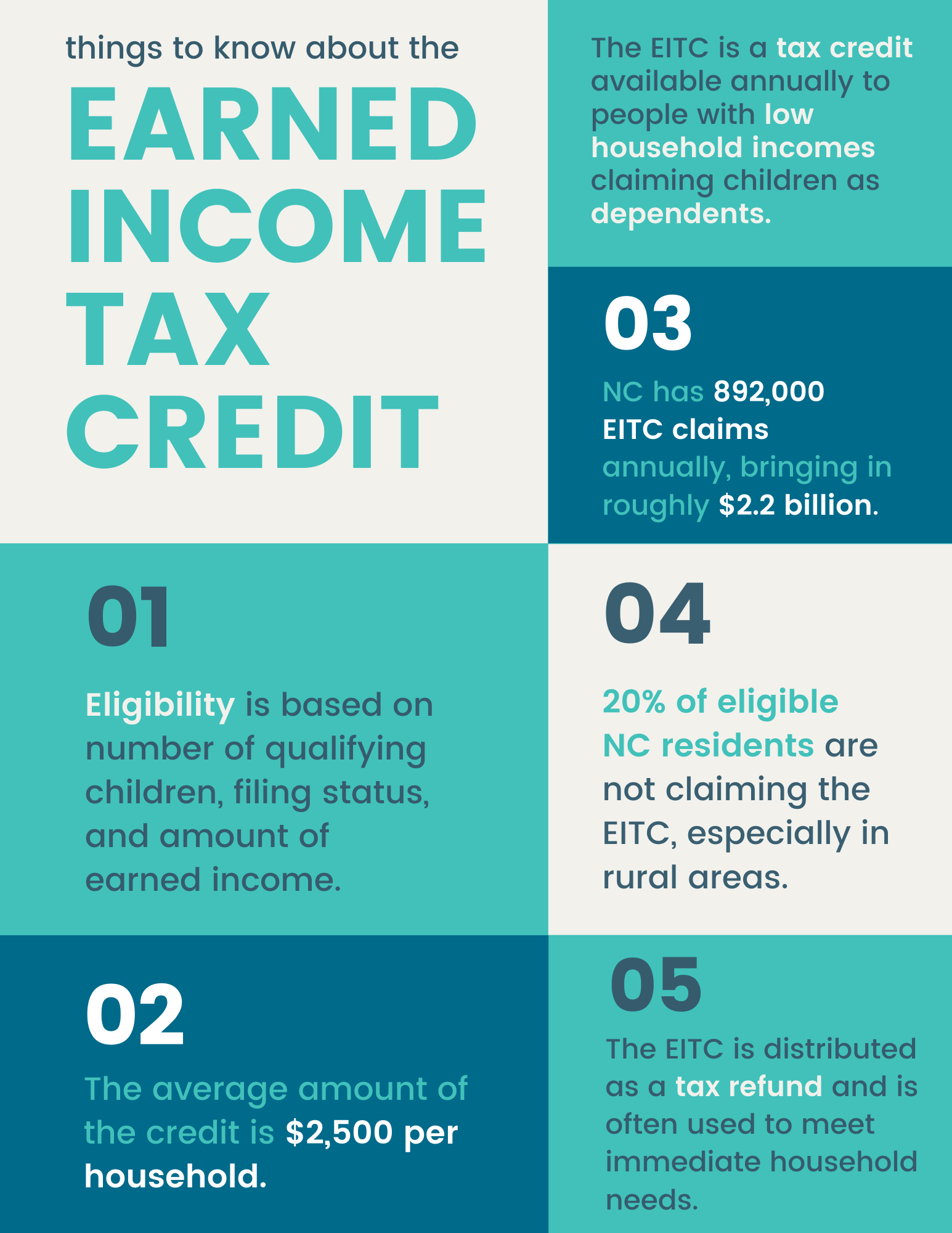

The Earned Tax Credit (EITC) A Primer Tax Foundation, Check the irs website for income limits and other eligibility requirements based on your filing status and dependents. If you have a qualifying child,.

EITC TAX CREDIT 2025 EARNED TAX CREDIT CALCULATOR 2025 YouTube, You have until may 17, 2025 to file a tax return (or an amended return) for the 2025 tax year. Who is eligible, and how to claim it in tax year 2025 and 2025.

Earned Tax Credit (EITC) Hawai'i Workers Center, In 2025, the irs has implemented changes to the eitc and the child tax credit to reflect current economic conditions and legislative updates. Who is eligible, and how to claim it in tax year 2025 and 2025.

Easiest EITC Tax Credit Table 2025 & 2025 Internal Revenue Code, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. File form 1040, form 1040a, or form 1040ez.

What is the EITC and How Does it Work? Montana Budget & Policy Center, To claim the earned income tax credit (eitc), you must have what qualifies as earned income and meet certain adjusted gross income (agi) and credit limits for the current, previous and upcoming tax years. If you're curious about how the income you earn in 2025 might shape your eligibility to claim the eic on your 2025 tax return,.

Increasing Family Wealth through EITC The Jordan Institute for Families, Taxpayer claiming the eitc who file married filing separately must meet the eligibility. For 2025, the maximum level of investment income was set at $11,000, increasing to $11,600 in 2025.

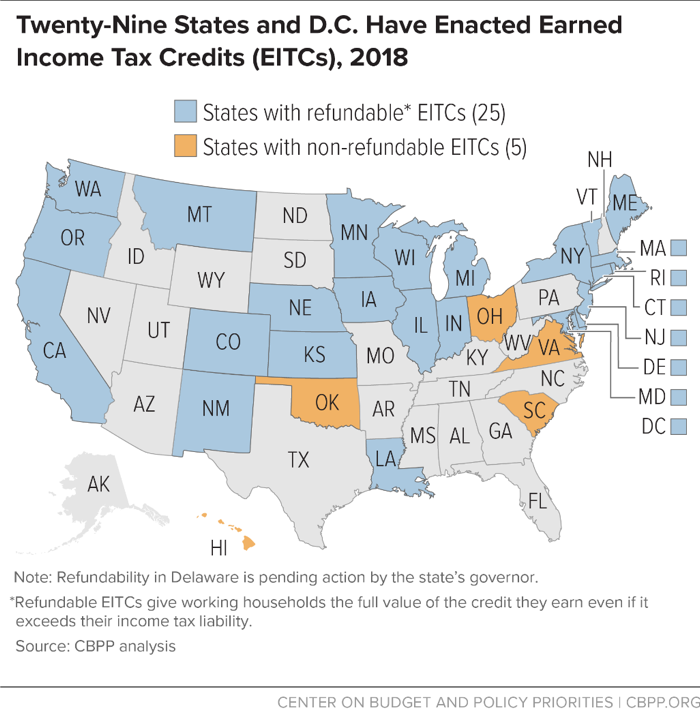

State EITC Expansions Will Help Millions of Workers and Their Families, While you have until april 18, 2025 for the 2025 tax year and april 18, 2026 for the 2025. 26, 2025 — the internal revenue service and partners around the nation today launched the annual earned income tax credit awareness day outreach.

Earned Credit 2025 Chart Hot Sex Picture, Use the eitc tables to look up maximum. Income limits and amount of eitc for additional tax years.